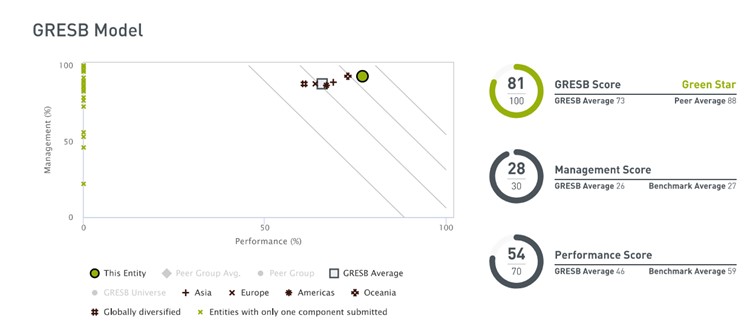

Amsterdam 13 October 2021 – The two funds of Rockfield, DSYPH and DULV, have once again improved their score in the GRESB Real Estate benchmark and score well above the average in the leading group of European housing funds.

GRESB is the ‘Global ESG Benchmark for Real Assets’. The GRESB Real Estate benchmark measures the sustainability performance of real estate portfolios and their managers worldwide. Over 1,200 participants took part, representing 96,000 properties in 64 countries. Participants report their sustainability performance via an assessment that evaluates strategy and policy, processes, risk management, and stakeholder engagement. Additionally, it measures the actual performance of properties in the portfolios, including energy use, CO2 emissions, water consumption, and waste collection, and compares these results with those of other participants. For more information, see here: GRESB.

Both funds scored an average of 82 points, improving by 6 points compared to the previous year. Both funds maintain their Green Star Rating. The average score of GRESB participants worldwide also improved this year, from 70 to 72 points. The Rockfield funds performed well above this average score, finishing in the top 25 of over 100 participating European housing funds.

When broken down by the sustainability components Environmental, Social, and Governance (ESG), both funds perform particularly well in the Social category. For example, DSYPH achieved the maximum possible score in this area. This result reflects Rockfield’s focus on tenant well-being and shows that Rockfield’s approach in this regard is highly valued. The Environmental score is also well above average, largely due to the focus on investing exclusively in new construction properties that meet the highest sustainability standards and perform well in the energy consumption benchmark.

“We are proud of the improvement in our scores and our position among the leading European housing funds,” says Catharina Klandermans, ESG Team Manager at Rockfield. “At the same time, we continue to work on improvement. We refine our strategy and implement it further in our work. We also set increasingly higher standards for the sustainability performance of the properties we acquire on behalf of our funds.”